Non-deposit products are: not insured by the FDIC;

are not deposits; and may lose value.

Written by: Rodney Hathaway, Chief Investment Officer, and Annette Klare, Retirement Services Relationship Manager

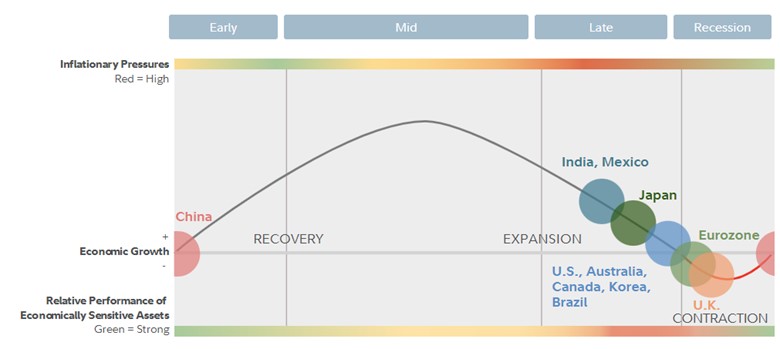

The topic of a pending recession may have many concerned as to how it may impact investment accounts and retirement savings. We are now three years removed from the last recession, the brief but severe plunge during the onset of the Covid-19 Pandemic. Since 2020 both consumers and businesses have been on a spending spree which has expanded the U.S. economy to over $26 trillion. Job growth has been strong, wages have been rising and companies have been adding to capacity to meet increased demand. However, this expansionary period has not come without growing pains, as inflation and interest rates have also shot up. The combination of high inflation and interest rates is now threatening to drive us into another recession. In-fact the Bloomberg Consensus is predicting a 60% probability that the U.S. economy will enter a recession sometime in the next 12 months.

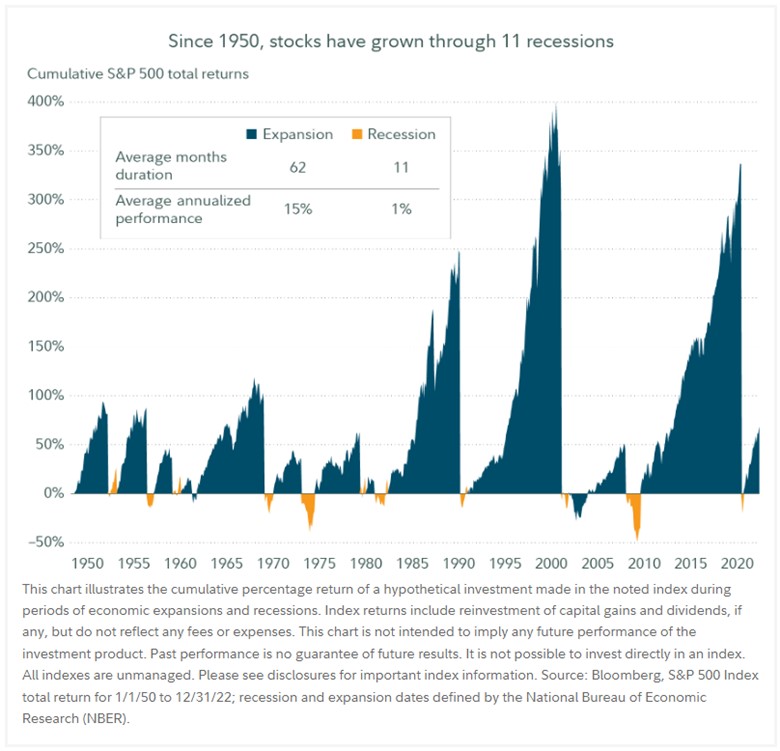

Recessions have typically been a period where most investors experience a loss of value with their assets. However, recessions are normal to business cycles, and one might argue necessary. A few key points to remember however when it comes to recessions. First, no two recessions are the same. Length of time and which industries are impacted more vs. less are examples of how they can be different. Second, recessions are not necessarily bad for the stock market. They act as catalyst to help weed out weak companies or drive positive changes to adapt. Third, investing during a recession has often turned out to be a good idea. Although historical performance is not a guarantee of what will happen in the future, over the past seventy years stocks have experienced periods of growth following the eleven recessions that occurred during that time.

If your anxiety level is high as to how an impending recession might impact your investment portfolio, we recommend you first look at how your account has performed over the past few years since the last recession. While past results are not a predictor of future performance, determining your comfort level with recent volatility in the market will help you and your advisor ascertain whether your mix of stocks to bonds is at an appropriate level. Most importantly, you should have a well thought out strategy crafted with the help of your advisor and then have the discipline to stick with it.

Always a good idea to review your asset allocation – what do you have in stocks vs. bonds? If you are closer to retirement (over 50), you may want to consider the unique environment that we are in regarding bonds. Over the next few years, the return on bonds is expected to nearly equal the expected return on stocks. If the expected return for both of these asset classes are the same, then it may make sense for someone looking to reduce their risk by shifting a portion of their stocks into bonds – or at least consider making their overall asset allocation a bit more balanced. Most economists expect the Fed to be nearly finished with short-term interest rate hikes. The economy is also showing signs of cooling, which is coinciding with lower inflation. If we are at peak interest rates, then the prospect of bond price appreciation over the next couple of years is good. Regardless of where you think interest rates are heading or whether we will experience a recession in the next year, the most important message to take away is you should have a well thought out strategy crafted with the help of your advisor. Once your game plan is in place, have the discipline to stick with it.