Non-deposit products are: not insured by the FDIC;

are not deposits; and may lose value.

Written By: Rodney Hathaway, Chief Investment Officer

Over the past 50+ years, the U.S. economy—along with global markets—has experienced multiple cycles of expansion and contraction. In fact, since the late 1960s, when I was born, the U.S. has gone through roughly seven recessions.

At Waukesha State Bank Wealth Management, we’re not economists, and we don’t have one on staff. However, our clients often ask us about our outlook on the economy. That’s why it's essential for our investment team to track and analyze key economic and market data. Our goal is to help clients confidently navigate both the peaks and valleys of the market cycle.

While no one can precisely predict the timing of economic turning points, historical trends offer valuable guidance on how to position portfolios for the long term.

Slowing U.S. Growth: A Long-Term Trend

One significant trend we’ve observed is the gradual slowdown in U.S. economic growth over the past two decades.

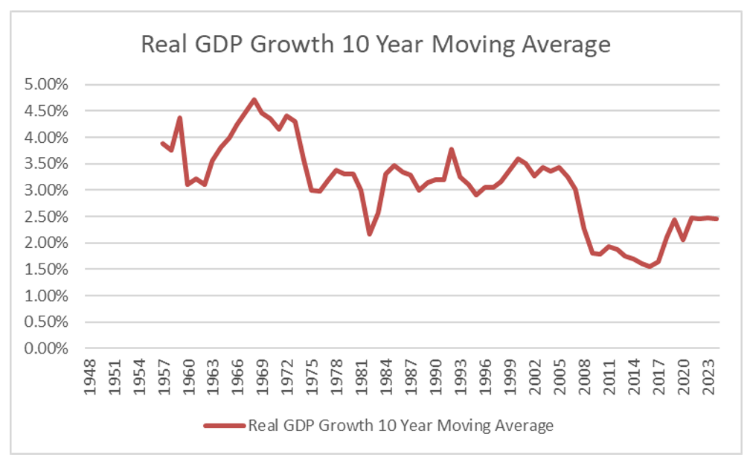

To better understand this, our team created a chart showing the annual growth of the U.S. economy using a 10-year rolling average, going all the way back to the 1950s. The rolling average helps smooth out short-term volatility and provides a clearer picture of long-term trends.

Historically, from the 1960s through the 1990s, U.S. economic growth hovered between 3% and 3.5% annually. However, starting in the early 2000s, that trend shifted. Growth fell to approximately 2% per year, and it has largely remained at that level since.

What makes this decline particularly noteworthy is that it occurred during a time of rapid technological advancement. The rise of the internet, high-speed mobile connectivity, and now artificial intelligence have all promised greater productivity. So why hasn’t economic growth kept pace?

What's Holding Growth Back?

In our view, a major factor behind this slowdown is rising government spending—a concern many taxpayers share. Despite productivity improvements through technology, fiscal expansion has continued to increase, often at an unsustainable pace.

This past summer, the government passed the Big Beautiful Bill, sparking new conversations about whether spending discipline might finally return to Washington. The bill also included tax cuts, raising the question: Could we see a reversal of the downward growth trend that began more than 25 years ago?

We’ve seen some historical precedent for this. The Tax Cuts and Jobs Act of 2017, passed during the first Trump administration, was followed by an acceleration in GDP growth. Whether this pattern repeats remains to be seen—but there are early indicators of optimism.

Early Signs of Acceleration?

For the first half of 2025, U.S. GDP growth came in at 1.4%, but more recently, the Atlanta Fed has forecasted 3% growth for the third quarter.

Markets appear to be responding positively to this potential upturn:

- The Dow Jones Industrial Average and the Russell 2000 Small Cap Index both outperformed the S&P 500 in August.

- This rotation toward value and small-cap stocks may be signaling renewed confidence in broader economic growth.

In anticipation of this, our team increased our allocation to small-cap equities at the end of 2024, a move that aligns with our view of potential economic momentum in the latter half of this year.

Preparing for Uncertainty

While recent data points to continued growth, some analysts are beginning to raise concerns about a potential recession in 2026.

As always, timing such events is notoriously difficult. That’s why our focus remains on building resilient, diversified portfolios—designed to perform reasonably well in both expansionary and recessionary environments.

Let’s Talk About Your Strategy

If you’re wondering how this economic backdrop might impact your financial plan or investment strategy, we encourage you to connect with one of our advisors. We're here to provide insights and guidance tailored to your unique goals.