Non-deposit products are: not insured by the FDIC;

are not deposits; and may lose value.

Written by: Rodney Hathaway, Chief Investment Officer

Given the notable market sell-off over the past month, we thought it was timely to address how to position your investment portfolio during a downturn.

A Look at the Current Market

The primary driver behind the recent dip in stock prices has been uncertainty surrounding tariff strategies. Year-to-date, the S&P 500 is down more than 10%, and has declined 14% from its recent high on February 19th.

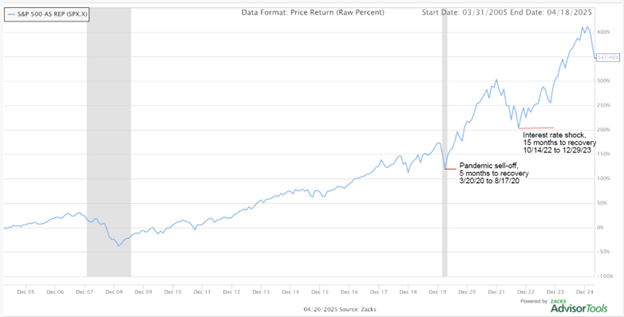

Although it's impossible to precisely time a market bottom, history offers valuable perspective: stock prices have always rebounded from downturns to eventually reach new highs. In fact, recent sell-offs have seen full recoveries within 15 months or less:

- In Q1 of 2020, stocks plunged due to the COVID-19 pandemic but recovered and reached new highs by year-end.

- After the interest rate-induced sell-off in 2022, markets bounced back in just over a year.

With this context, market corrections can be viewed not as moments of panic—but as opportunities. Let’s explore how to take advantage of these "market sales."

How to Prepare for Market Corrections

The key to capitalizing on downturns is preparation. That means doing your homework before a market correction occurs so you can act strategically, not emotionally.

Start by creating a wish list of high-quality companies. Look for businesses with:

- Leading market share

- Blue-chip customer bases

- Best-in-class technology

Often, these companies trade at premium valuations—more than you're willing to pay under normal conditions. But during a market correction, prices fall across the board. These same top-tier companies suddenly become more reasonably priced.

A Quick Analogy: Quality vs. Price

Think about it like buying furniture. You could go with Ethan Allen, known for quality craftsmanship and long-lasting products—but it comes at a higher price. Or you might choose IKEA, which offers more affordable, functional furniture made with less durable materials.

When the market dips, those Ethan Allen-quality companies may temporarily be priced more like IKEA—giving savvy investors a chance to buy high-quality assets at discounted prices.

But What About the Bigger Picture?

Before acting, consider the broader macroeconomic environment. Even during volatile times, it’s important to assess whether the fundamentals support long-term growth.

Let’s reflect on where we stand today:

- We entered 2025 on solid economic footing.

- While there's been some slowing, growth remains intact.

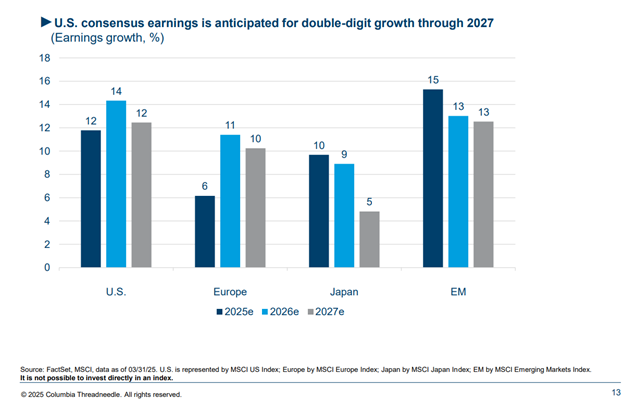

- Corporate earnings growth projections remain strong for the coming years.

Admittedly, things have shifted slightly in recent weeks. But remember: the U.S. economy—worth over $29 trillion—doesn’t stop on a dime. People are still eating out, retailers are still making sales, and manufacturers are still producing.

If trade negotiations were to completely break down, a deeper slowdown or recession could follow. However, the current guidance from the Trump administration suggests active engagement with global trade partners. While these negotiations will take time and may require Congressional approval, we believe progress will be made.

The U.S., as a net buyer in most global trade relationships, holds significant leverage. Even imperfect agreements could restore confidence and reaccelerate capital investment.

Turning Strategy into Action

Yes, the volatility we’ve experienced this month has been driven in large part by policy uncertainty. However, because we began the year with strong fundamentals, we expect a full and relatively swift recovery once clarity emerges from Washington.

That’s why we’ve been actively repositioning client portfolios:

- We’ve upgraded certain holdings.

- We’ve purchased stocks from our wish list at newly attractive prices.

- For clients with excess cash, we’ve used the opportunity to buy into the market.

With the improved risk-reward profile of equities, we’re feeling more optimistic about the months ahead.

Final Thoughts

Market corrections are inevitable. But when viewed through a long-term lens, they also offer opportunity. With thoughtful planning and a steady hand, we can use these moments to strengthen portfolios and position for future growth.

As always, we welcome your questions and are here to support your financial journey.