May 2020

With all of the changes in the past few weeks due to COVID-19, we’ve all been relying more and more on online and mobile tools for everything from attending virtual work meetings or social gatherings, to teaching our students and ordering groceries. One tool that has been especially helpful during these uncertain times for contactless banking is Mobile Deposit.

Your smartphone is a powerful tool, and it can do wonders to streamline the way you handle your finances. While over 75 million people use mobile banking apps on their smartphones, a survey by the Federal Reserve shows that only about 38 percent have tried making a mobile check deposit. If you’re looking to join that 38 percent, here are five points to help you get the most out of this technology.

The basics

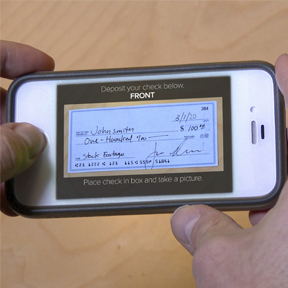

To make a mobile deposit, you’ll need to photograph both sides of your endorsed check. This will be read by Waukesha State Bank’s automated software through our Mobile Banking app. Before you submit the check for processing, you’ll have to fill out a few details, such as the check’s amount and where you’d like the check deposited. After that, submit your check and wait for it to post.

Brush up on photography

To deposit your money, the bank’s software needs a clear, clean image of the check. Instead of holding the check, place it on a plain, dark background. Make sure the check is flat, well lit, and crisply in focus. You should be able to read all of the information on the check from the picture you submit. According to Marek Helcl, an industry expert in the mobile banking field, it’s important to remove anything attached to the check, such as a pay stub. Furthermore, your photo should capture the entire check, not a zoomed-in portion of it. While it may take a few extra minutes to set up the shot, it’ll prevent you from having to deal with check rejections and unnecessary delays in fund availability.

Keep a record of your transactions

After making a mobile deposit, it’s a good idea to keep the original paper check for two to three weeks, just in case an issue arises. It can be extremely difficult to resolve any problem without the check in hand, so keep it in a secure location. You should also note the date and mark the check as a mobile deposit to prevent your significant other from accidentally double depositing it, since this mistake can result in a fee. Once the check has been successfully deposited you should shred it so criminals can’t use its information for nefarious purposes.

Delayed availability

While you can send and receive pictures, texts and emails almost instantaneously, your mobile check deposits must follow the same procedures as checks deposited in person. That means, the deposited funds are normally available the next business day, as long as the mobile deposit is accepted before 5:30 PM (CST).

Be aware of fees

Some financial institutions may charge a nominal fee every time you use the service — typically around $0.50 per check. Rest assured, with Waukesha State Bank, Mobile Deposit is FREE!

Deposit limits

Waukesha State Bank’s maximum deposit amount per day is $4,000. While some institutions may not place limits, this is aimed at preventing fraud and keeping you, and your money, safe.

So, how do you get started? For current VaultLink Online Banking users, simply search for "Waukesha State Bank" in the app store to get started. If you aren’t already using VaultLink Online Banking, click here to enroll.

If you have any questions, call our Customer Service Center at (262) 549-8531, or chat with them online.