Non-deposit products are: not insured by the FDIC;

are not deposits; and may lose value.

Written by Rodney Hathaway, Chief Investment Officer

There have been a lot of press announcements over the past several months on various investments being made in the U.S. by corporations and foreign countries. Will these investments drive economic growth? Let’s dive in!

What Is FDI and Why Does It Matter?

Foreign Direct Investment (FDI) refers to an ownership stake in a company or project by an investor, business, or government from another country. In economic terms, it’s often considered a powerful engine for growth—bringing capital, jobs, and technology into the host nation.

Throughout the early 2000s, FDI largely flowed into emerging markets like Brazil, Russia, India, and China—commonly referred to as the BRIC nations. In particular, China’s entry into the World Trade Organization in 2001 triggered a flood of FDI that helped propel its economy to the number two spot globally, just behind the U.S.

The Shift Away from China and Russia

Recently, the global FDI landscape has seen a dramatic shift. China’s handling of the COVID-19 pandemic and its tightening government controls have led to a sharp decline in foreign investment since 2019. Russia’s invasion of Ukraine in 2022 prompted nearly all foreign corporations to exit the Russian market entirely.

As investment flows redirect, the United States has emerged as the primary beneficiary. In fact, the U.S. has led the world in FDI receipts for the past five years—an unprecedented trend in the modern investment era.

The Scale of Investment: A Historical Surge

Here at Waukesha State Bank, our research team compiled data from press releases and government filings, and the numbers are staggering. Since 2024, approximately $5.5 trillion in investment commitments have been announced:

- $3.4 trillion from foreign countries

- $2.1 trillion from corporations, many of which are also based overseas

To put that in perspective, U.S. GDP in 2024 was around $29 trillion, meaning this FDI surge represents a meaningful boost to economic activity over the coming years.

Beyond the raw figures, this wave of FDI is expected to have a multiplier effect, creating secondary and tertiary job opportunities in local communities, particularly in regions where major projects are based.

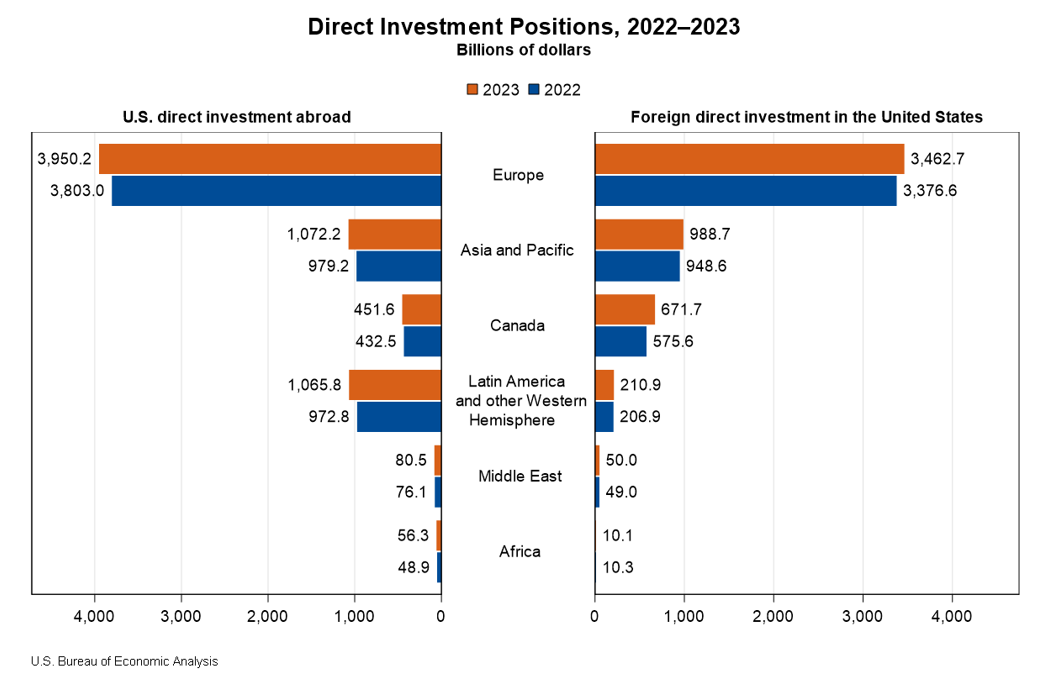

The chart below shows the level of FDI made by the U.S. abroad and the FDI dollars that have come into the U.S. in 2022 and 2023.

Notable Commitments from Global Partners

A closer look at recent FDI activity shows just how global—and concentrated—these investments are:

- Middle East nations such as the UAE, Qatar, and Saudi Arabia have jointly announced $3.2 trillion in FDI to the U.S.

- Japan has pledged $700 billion, with $500 billion of that coming from Softbank.

- Nippon Steel is set to invest $11 billion into U.S. Steel over the next three years, as part of an acquisition agreement backed by the White House.

This last point reflects a broader initiative by the current administration to revitalize U.S. manufacturing, especially in strategic industries like steel production.

Sectors Seeing the Most Investment

FDI is not being spread evenly. It’s concentrated in high-impact sectors:

- Technology and Artificial Intelligence are top of the list, receiving $1.6 trillion of the corporate investment total.

- Manufacturing and Pharmaceuticals are also seeing significant allocations.

These sectors are critical to national security and long-term competitiveness, making this capital injection all the more strategically significant.

The Tax Factor

Tax policy plays a vital role in attracting FDI. The reduction of the U.S. corporate tax rate to 21%, implemented during the Trump administration, has made the U.S. a highly attractive destination for global capital. As Congress debates the proposed “Big Beautiful Bill,” the future of the corporate tax structure hangs in the balance.

If passed, this bill could offer the certainty and incentives needed to solidify the U.S. as the premier destination for foreign and corporate investment. The White House is aiming for its passage before the Independence Day holiday, which could also serve as a much-needed boost to market sentiment during the typically quiet summer months.

Looking Ahead

Even if consumer sentiment remains cautious in the near term, this extraordinary $5.5 trillion investment wave is likely to provide a long-term tailwind for U.S. economic growth. The scale, diversity, and strategic focus of these investments suggest a transformation that could reshape America’s economic landscape for decades to come.

References and Further Reading

- UAE commits to $1.4 trillion US investment, White House says | Reuters

- Fact Sheet: President Donald J. Trump Secures Historic $1.2 Trillion Economic Commitment in Qatar – The White House

- Saudi Arabia floats $600 billion investment in US | AP News

- Ishiba Pledges to Boost Japan’s Investment in U.S. to $1 Trillion; Trump Says Meeting with Nippon Steel Execs Scheduled - The Japan News

- https://www.wsj.com/business/nippon-steel-finalizes-purchase-of-u-s-steel-after-reaching-security-deal-with-trump-administration-5d012a2e?st=MTxtFK&reflink=desktopwebshare_permalink

Disclosure: This content is for informational purposes only and does not constitute investment advice. Please consult your financial advisor for personalized guidance.