Non-deposit products are: not insured by the FDIC;

are not deposits; and may lose value.

Written by Rodney Hathaway, Chief Investment Officer

A dozen straight wins means free burgers for everyone, compliments of George Webb!

Our hometown favorite baseball team, the Milwaukee Brewers, notched their 12th consecutive win on August 13th by sweeping the Pittsburgh Pirates at American Family Field. Local restaurant chain George Webb will make good on its promise to give away free hamburgers in celebration of the Brewers 12 straight wins. This continues a tradition George Webb began in the 1940s and has only been fulfilled twice, once in 1987 and again in 2018. News of this momentous accomplishment has even made its way to the east coast with the Wall Street Journal reporting this week on George Webb’s generous offer. Streaks of this nature are truly rare indeed, but Americans have always been enamored with teams that are on a winning roll.

The stock market has been on its own winning streak as of late with the S&P500, Dow Jones Industrial Average and Nasdaq Composite hitting all-time highs here in mid-August. Considering the wall-of-worry the market has had to climb all year, many investors including ourselves are a bit surprised at how resilient stock prices have been. Whether it’s been missile attacks in the Middle East, the ongoing conflict between Russia and Ukraine or global trade wars, not much has seemed to shake the relatively sanguine sentiment of U.S. investors. It is always difficult to predict what could change investor sentiment, but it often follows shifts in underlying fundamentals.

What do we mean by fundamentals?

For the stock market it’s things like Revenue and Earnings growth, but more specifically whether those growth rates are accelerating or decelerating. While it’s easy to calculate what historical growth rates have been, what we really want to know is what the future growth rates will be. We know from experience that future growth is directly related to the amount of capital that companies and individuals invest in their businesses. When decision makers are optimistic, they tend to invest, pretty straight forward.

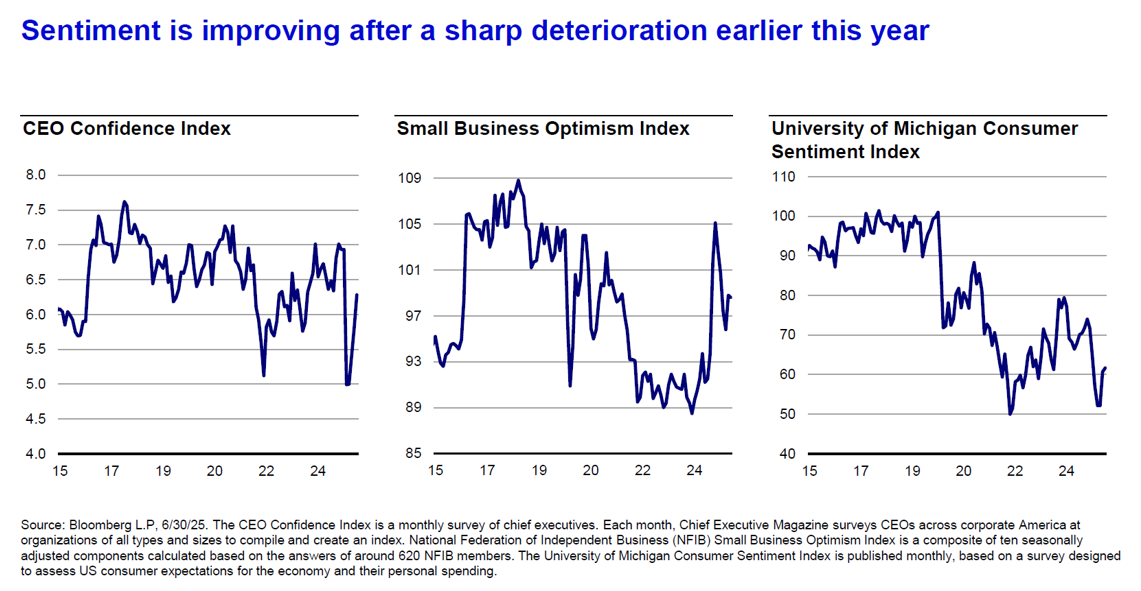

You can see in the chart below that sentiment for CEOs, small businesses and consumers all took a dip earlier this year right around Liberation Day but has since then rebounded.

While overall sentiment is well off previous peak levels, they are currently heading in the right direction.

In baseball terms, when you get to the late summer months, it is not just the overall win-loss record that is important, but rather which teams are heading into the playoffs with good momentum. Currently the Brewers are the hottest team in baseball so hopefully that momentum continues into the playoffs which begin in a little over a month from now. For our investment clients, we remain cautiously optimistic on the fundamentals for the economy and market. Barring an injury to key players, we are looking forward to the fall season where we are still finding opportunities for growth.

We would love to discuss some of those areas of growth opportunities with you, so please don’t hesitate to call one of our investment team members here in Wealth Management.

As always, thank you for tuning in this month and we look forward to future chats with you!

Go Brew Crew!